« on: February 07, 2023, 07:36:09 pm »

SYNOPSIS OF UNION BUDGET 2023 (AMENDED) UPDATED WITH WEST BENGAL STATE BUDGET 2023

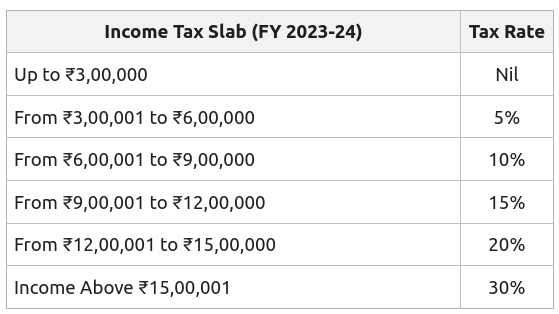

• Rates of Income Taxes under New Tax Regime - Individual

New Tax Regime to be applied on default basis, however assesses to have option to opt for taxation under Old Tax Regime.

Revised applicable slab under New Regime is tabulated below:

Following deductions will be available under New Tax Regime:

i. Standard Deduction increased to INR 52500 u/s 16(ia) of the IT Act.

ii. Deduction u/s 57(iia) of the IT Act from Family Pension Income up to INR 15000; and

iii. Deduction of amount paid/deposited in the Agniveer Corpus Fund u/s 80CCH (2) of the IT Act.

• Rate of Surcharge - Individual

Maximum rate of surcharge is proposed to be restricted to 25% as against 37%. This results the maximum effective tax rate to 39% from earlier 42.7%. Further, it is proposed that in case where the members of the AOP consists of only companies, the maximum rate of surcharge be restricted to 15%.

• Rebate under Section 87A of IT Act - Individual

Threshold for rebate on the income tax payable under Section 87A of the IT Act increased to INR 7lakhs from INR 5lakhs, applicable for assesse opting taxation under New Tax Regime.

• 1 crore Tax Filers in INR 5-7 lakh slab to benefit from new I-T plan

• World's Highest Personal Income Tax Rates (in %)

Sl. No. Country (%)

1 Hongkong 15

2 Singapore 24

3 Canada 33

4 Philippines 35

5 Thailand 35

6 USA. 37

7 INDIA 39

8 France 45

9 Germany 45

10 Australia 45

11 China. 45

12 UK 45

13 Japan 56

14 Sweden 57

• Maximum Deposit Limit enhanced for Senior Citizen Savings Scheme from 15 lakhs to 30 lakhs and for Post Office Monthly Income Scheme from 4.5 lakhs to 9 lakhs (single account) & to 15 lakhs (joint account).

• Mahila Samman Savings Certificate introduced tobe applicable till March 2025 at an interest rate of 7.5%.

• Anti-avoidance measure

i. Section 56(2)(viib) of the IT Act provides for taxation of the amount received by a taxpayer on issue of shares in excess of the fair market value from residents. It is now proposed to bring non-residents under its purview effective from the AY 2024-25.

ii. Further to widen the scope of Section 9 of the IT Act covering deemed gifts from residents to RNOR has now been proposed to curb tax avoidance. Currently, any sum of money exceeding INR 50,000 gifted by a Resident to a Non-Resident is taxed in the hands of the Non-Resident, if not within permissible Relation.

• Deduction with respect to Interest on Housing Loan

To avoid double deduction on interest under section 24 or under other provisions of Chapter-VIA, it has been proposed that the cost of acquisition of the asset or the cost of improvement thereto shall not include the deductions claimed on the amount of interest.

• Restriction on Investment in Residential Property for availing deduction on Capital Gains u/s 54 & 54F

A threshold limit has been introduced on maximum deduction which can be claimed for cost of new asset purchased Under Sections 54 and 54F to INR 10 crores. Corresponding amendments have also been proposed to be made for amounts to be deposited under Capital Gains Account Scheme under both the sections to INR 10 crores.

• Capital gains not to be attracted on conversion of Gold to Electronic Gold Receipt and vice versa

The conversion of Physical Gold to Electronic Gold Receipt and vice versa is proposed not to be treated as a transfer and not to attract any capital gains.

• Taxation on Sum of Insurance amount received on maturity

Income from insurance policies received [other than in case of Death], having a premium above INR 5 lakhs (individually/in aggregate) in a financial year shall be taxable as ‘Income from Other Sources.

Deduction of aggregate premium paid will be allowed if not claimed before. The proposed provision shall apply for policies issued prospectively I.E. On or after 1stapril, 2023. This will, however, not apply to any sum received on the death of a person and also not applicable to unit-linked insurance plans.

• Changes brought in TDS provisions

i. Rate of TDS on winnings from online games @30% has been proposed. Tax will be on net winnings without any threshold limit. However, for lottery and crossword puzzle games, the threshold limit of INR 10000 for TDS will continue. Games of skill and games of chance have been treated on the same plane.

ii. Restricting TDS at 20% instead of TDS at MMR on payment of accumulated balance of PF in case of failure by employee to furnish the PAN.

iii. Threshold limit of 3 crores to be applied for TDS u/s 194N, in case recipient is Cooperative Society.

iv. Amendments proposed to include cash benefits within the ambit of the benefit or perquisites chargeable to tax under the Section 28(iv) and corresponding amendment in Section 194R of the IT Act.

v. The business trust deducting TDS at 5% on interest income of NR unit holders to be eligible for certificate for deduction at lower or NIL rate.

vi. Proposed to omit clause (ix) of the proviso to section 193-exemption from TDS on payment of interest on listed debentures to a resident.

• Introduction of tax authority

In order to reduce burden of CIT (A) and to ensure speedy disposal of cases, a new authority of Joint CIT(A) is proposed to be created. It will have powers, responsibilities and accountability similar to CIT (A).

• Mismatch in TDS Credit

Taxpayers are allowed for making application to the AO within 2 years from the end of subsequent FY in which TDS deducted in case of TDS credit mismatch on account of cash system followed by deductor for TDS deduction.

• DTAA relief for TDS

DTAA relief is proposed to be made available for TDS under Section 196A of the IT Act with respect to certain income of a non – residents relating to units of mutual funds.

• Increase in timelines for completion of assessment or reassessment

Completion of assessment proceedings is proposed to increase from 9 months to 12 months from the end of the assessment year in which the income was first assessable. Further, in the case of an Updated Return the timeline is proposed to increase to 12 months from the end of the FY in which such return is furnished.

• Penalty introduced for false self – certification and failure to deduct tax

Penalty of INR 5,000 for a false self-certification of a statement in respect of specified financial transaction and penalty and prosecution for a person who fails to deduct or pay tax as per Section 194R, 194S and 194BA of the IT Act.

• Increase in TCS rate on LRS remittances

Proposes to increase TCS from 5% to 20% for certain classes of overseas tour packages and other foreign remittances (except for the purpose of education or medical treatment) to be effective from July 1, 2023. The bill proposes a new capital gains provision for market-linked debentures, taxing income from insurance policies where the premium is more than INR 5 lakhs and TDS to be deducted on interest payments on listed debentures.

• Leave Encashment increased to Rs.25 lakhs

The maximum amount which can be exempted has been increased from Rs.3 lakhs to Rs.25 lakhs upon retirement of non-government salaried employees.

• Addendum of West Bengal State Budget 2023

Joy for Home Buyers &Sellers

i. Stamp duty on residential properties in urban areas priced below Rs. 1 crore reduced from 6% to 4%

ii. Stamp duty on residential properties in urban areas priced above Rs. 1 crore reduced from 7% to 5%

iii. Stamp duty on residential properties in rural areas priced below Rs. 1 crore reduced from 5% to 3%

iv. Stamp duty on residential properties in rural areas priced above Rs. 1 crore reduced from 6% to 4%

v. Circle rates cut by 10%

This SOP has been extended upto September 30, 2023

• Finance Bill 2023 passed with 64 Amendments

DEBT FUNDS LOSE LONG-TERM CAPITAL GAINS BENEFIT

i. No LTCG benefit for debt funds with less than 35% in equities

ii. Income from debt funds to be taxed at slab rate of taxpayer

iii. Parity in taxation with bank fixed deposits

iv. Applicable prospectively from FY24

v. No indexation benefit

20% WITHHOLDING TAX ON ROYALTY/TECHNICAL FEE PAYMENTS

i. Withholding tax rates raised to 20% from 10% on payments to Non-Residents

ii. India will be able to levy the tax treaty rate of 15% on US, UK Cos

iii. It was unable to levy this rate as domestic rate was lower at 10%

iv. Non-treaty countries will also face the higher 20% withholding tax

25% HIGHER STT ON F&O

i. Securities Transaction Tax on options sale raised to 0.0625% from 0.05%

ii. STT on futures raised to 0.0125% from 0.01%

iii. May Impact F&O volumes on exchanges

Credit card used for foreign travel will attract TCS @ 20% except education and medical purpose

Tax Relief for marginal income earner over and above Rs. 7, 00,000 in New Tax Regime

TDS on online gaming will now be effective from 1st April, 2023 instead of 1st July, 2023

Disclaimer:- (You are advised to consult your Legal Counsel before taking any decisions. This is issued only for the purpose of public awareness and information. The Contributor or any of his employees/associates will not take any responsibility for any actions of the reader based directly or indirectly on the basis of the above Article.)

« Last Edit: March 25, 2023, 12:38:35 pm by D. Saha & Co. »

Logged

Contributor : D. Saha & Co.

E-mail Id. info@kolkatataxconsultants.in

Mob. 8420159817/9674797985