« on: February 10, 2025, 05:49:09 pm »

SALIENT FEATURES OF UNION BUDGET 2025

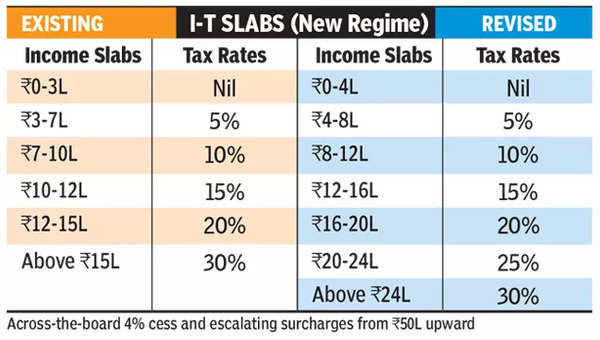

• No tax on income up to Rs. 12L, With standard deduction, salaried remain tax free up to Rs. 12.75L. Rebate of Rs.60k and tax slab rejig will result in savings up to Rs.1.1L.

• Updated Returns can be filed upto 48 months from end of assessment year. Rate of additional Income Tax payable for updated return filed after expiry of 24 months and up to 36 months – 60% of aggregate of tax and interest payable; 70% and interest payable after expiry of 36 months and up to 48 months.

• No deemed rent for 2 self-occupied house properties

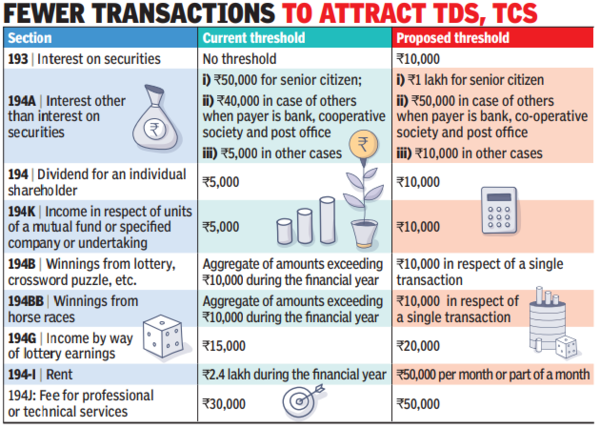

• TDS on house rent to apply only beyond Rs.6L a year against earlier Rs. 2.4L

• For senior citizens, withdrawals from national small savings (NSS) accounts post Aug 29, 2024 to be tax exempt

• Payment to NPS Vatsalya eligible for deduction of Rs.50k, akin to NPS for the old regime.

• Income Tax Rebate of Rs. 60000 under new regime but non-applicable on income taxed at special rates (only for residents)

• Validity of registration of a Charitable Trust has been extended from the current 5 years to 10 years for smaller trusts with income below Rs. 5 crore.

• Exemption limit on gain from redemption of Listed Shares increased to Rs. 1.25L

• Income earned from redemption of ULIP being non-exempted will be qualified as capital gains.

• TDS for senior citizens on bank interest only above Rs. 1L. For others, threshold increased to Rs.50k. TDS on dividend income above Rs. 10k.

• Threshold for TCS on overseas remittances under the Liberalized Remittance Scheme (LRS) raised to Rs. 10L with education from loan out of bracket

Disclaimer:- (You are advised to consult your Legal Counsel before taking any decisions. This is issued only for the purpose of public awareness and information. The Contributor or any of his employees/associates will not take any responsibility for any actions of the reader based directly or indirectly on the basis of the above Article.)Please share your valuable suggestions/opinions/feedback.

Disclaimer:- (You are advised to consult your Legal Counsel before taking any decisions. This is issued only for the purpose of public awareness and information. The Contributor or any of his employees/associates will not take any responsibility for any actions of the reader based directly or indirectly on the basis of the above Article.)Please share your valuable suggestions/opinions/feedback.

« Last Edit: February 10, 2025, 05:57:41 pm by D. Saha & Co. »

Logged

Contributor : D. Saha & Co.

E-mail Id. info@kolkatataxconsultants.in

Mob. 8420159817/9674797985